- 29 Mar 2023

- 4 Minutes to read

- Print

- DarkLight

- PDF

Australian GST - Tax & Invoice Setup

- Updated on 29 Mar 2023

- 4 Minutes to read

- Print

- DarkLight

- PDF

You can ensure you comply with Australia's goods and services (GST) tax laws using our GST settings for Australian wineries. This page will outline the GST features and steps to get your winery set up correctly.

Wineries registered for GST should generally include 10% in the price charged for goods and services (1)(4). Most goods and services are taxable, except for a few exceptions (2). This is especially notable for wineries that also serve and sell Food, as food items not consumed on the premises are non-taxable (3). We have designed this feature with these conventions in mind. When correctly set up, the platform will automatically calculate 10% GST of the displayed price, with a line item stating "GST Included" displayed on receipts.

Pricing

Please ensure the prices you enter for your products include GST unless the item is tax-free (more below).

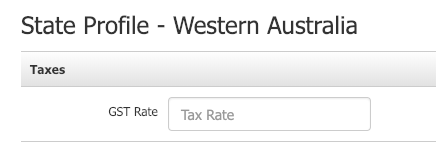

State Profile

To activate Australian GST for a winery, you must configure each state profile for Australia. You can do this easily by navigating each state profile and entering the tax rate - typically 10%. For instructions on how to configure State Profiles, click here.

Once the tax rate has been entered, the "GST Included" line item will automatically appear on all receipts. The GST-included line item will backward calculate the GST from the prices of all your products, as well as shipping and handling.

Receipts

Requirements for Australia Tax Invoices and Receipts

Entering the tax rate into the State Profile will complete most of the setup for this feature, but you must still ensure that your receipts meet the criteria outlined by the government. WineDirect has met these requirements; a full receipt setup checklist can be found in this section.

The basic requirements for issuing tax invoices are as follows (taken from the Government of Australia Website):

Tax invoices for taxable sales of less than $1,000 must include enough information to determine the following seven details clearly:

- That the document is intended to be a tax invoice - Tax Invoice has been indicated directly on the receipt

a. This information is included by default on all WineDirect receipts - the seller's identity

a. For PDF-style receipts for Admin Panel and POS (letter print), ensure to upload a PDF watermark including this information

b. For thermal POS receipts, the address/contact info and logo should be included in the header/footer image uploaded in the POS profile (alternatively, by not including a logo, the address for the POS location will be added in place of a logo)

c. For the order confirmation email, ensure that your address and logo have been uploaded to the email template - the seller's Australian business number (ABN)

a. For PDF-style receipts for Admin Panel and POS (letter print), ensure to upload a PDF watermark including this information

b. For thermal POS receipts, ensure to fill out the ABN field found in the website settings

c. For order confirmation information, ensure that your ABN has been included on the email template - the date the invoice was issued

a. This information is included by default on all WineDirect receipts - a brief description of the items sold, including the quantity (if applicable) and the price

a. This information is included by default on all WineDirect receipts - the GST amount (if any) payable – this can be shown separately or, if the GST amount is exactly one-eleventh of the total price, as a statement such as "Total price includes GST."

a. "Total Invoice GST" has been indicated on all WineDirect receipts - the extent to which each sale on the invoice is a taxable sale (that is, the extent to which each sale includes GST)

a. On all WineDirect receipts, "*Prices include GST" has been indicated

b. Any item (including shipping and handling) that includes GST has been marked with an asterisk (*).

In addition, tax invoices for sales of $1,000 or more need to show the following:

- the buyer's identity or ABN

a. If this is required, this can be achieved by adding the ABN to the contact information

Receipt Setup Checklist

- Upload a PDF watermark with a logo, address/contact information, and an ABN.

- Fill out the ABN field under website settings > Store > Orders

- Set up the POS profile and upload a receipt header/footer image that includes the logo and address/contact info.

- Customize your email templates to include address/contact info, logo, and ABN.

Tax-Free Items

If you would like to create a tax-free item, you can do this at the SKU level (here is how - see "Is Non-Taxable"). Items on a receipt that are non-taxable ARE NOT marked with an asterisk.

Shipping

Domestic shipping is taxable(6) and, by default, will be lumped into the GST-included calculations and marked by an asterisk. International shipping, however, is not taxable(6). If your winery plans to ship internationally, we recommend creating a tax-free international shipping SKU, as outlined in the abovementioned tax-free item.

Reporting

Total GST included is reported at the order level and can be found in the following reports under the "Total GST Included" column:

- Orders By Customer

- Orders By Number

- Orders By Ship/Pickup Date

- Sales Summary

- Sales Summary By Associate

- Sales Summary By State

Resources

- How GST Works: https://www.ato.gov.au/Business/GST/How-GST-works/

- GST Free Sales: https://www.ato.gov.au/business/gst/when-to-charge-gst-(and-when-not-to)/gst-free-sales/

- GST on Food: https://www.ato.gov.au/Business/GST/In-detail/Your-industry/Food/GST-and-food/

- GST Overview: https://www.ato.gov.au/business/gst/

- Australian Receipt Overview: https://www.business.gov.au/finance/payments-and-invoicing/receipts-and-proof-of-purchase

- Shipping GST: https://community.ato.gov.au/t5/General-tax-questions/Online-Business-applying-GST-on-postage/td-p/1291