- 07 Nov 2024

- 2 Minutes to read

- Print

- DarkLight

- PDF

Reports for taxes - Best Practices for Accountants

- Updated on 07 Nov 2024

- 2 Minutes to read

- Print

- DarkLight

- PDF

Accounting needs precise and detailed information. As there are many reports available in WineDirect Classic, this page will help business owners extract the best reports for accountants to use when reporting taxes for end of year statements.

Best Report for Tax Information

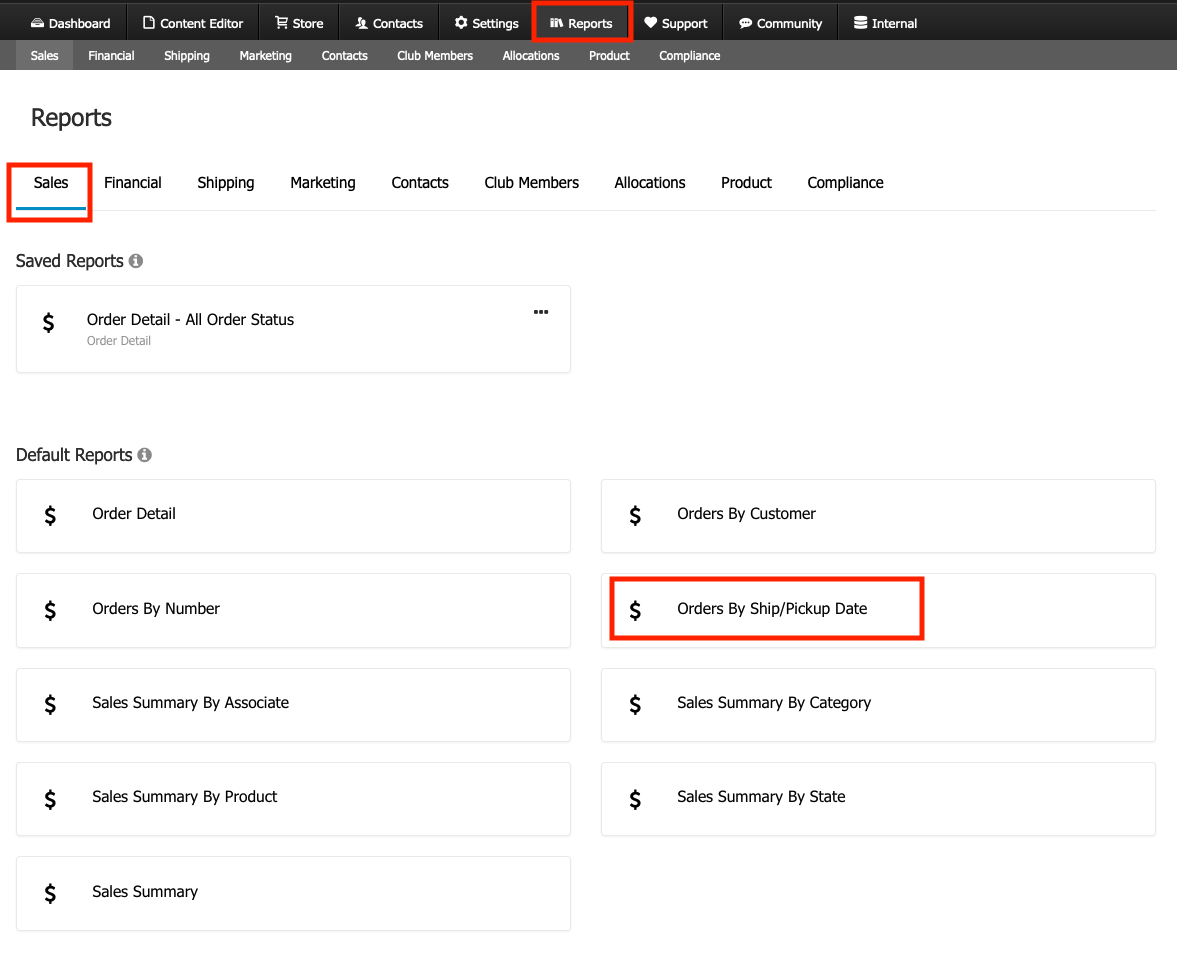

When looking into sales tax, we recommend that wineries use Order by Ship/Pickup Date Report.

To do that go to Reports > Sales > Order by Ship/Pickup Date.

After you extract the Order by Ship/Pickup Date for the date/period desired, if you are still finding errors, please contact support with one specific date for our investigation. Please note that, our support staff are not trained accountants and they can only investigate the technical side of the system.

The support team will be able to investigate one day to guide you to the potential solution so that you can continue making the necessary adjustments according to tax needs.

Payment Reconciliation - Matching Sales Deposits to Reports

Sometimes sales deposits received from WineDirect Payments seem to not be an exact match with wineries WineDirect reports. Even though you might think there is money “missing” or that your business was “paid too much”, we can assure you this is likely just a matter of adjusting your filters when generating your reports in WineDirect.

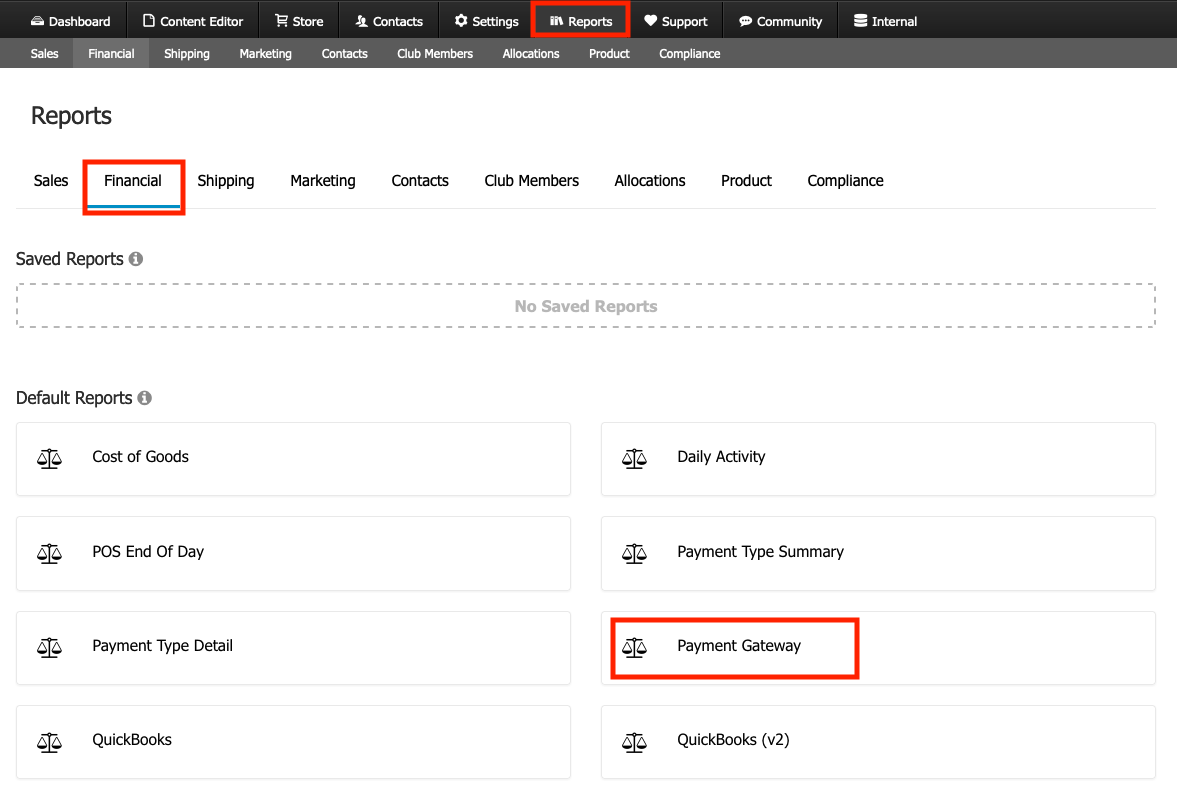

We recommend always starting from the Payment Gateway Report. Here are some of the best practices for payment reconciliation:

1. Go to Reports > Financial > Payment Gateway Report in WineDirect.

2. After extracting the report, try to see if there is an order number/order total that is missing. There are many potential causes for an order number or total to not be showing on your Payment Gateway report. The most common ones are:

- Staff might have voided the transaction from the payment tab - this action might make orders not show on reports.

.png)

- Vivopay may have had a glitch making orders “disappear” from order list/reports because the order might be stuck in pending order or payment status.

If orders you see in WineDirect Payment's reports are not showing in our WineDirect Ecommerce Payment Gateway Report, you will need to find the individual order in our system.

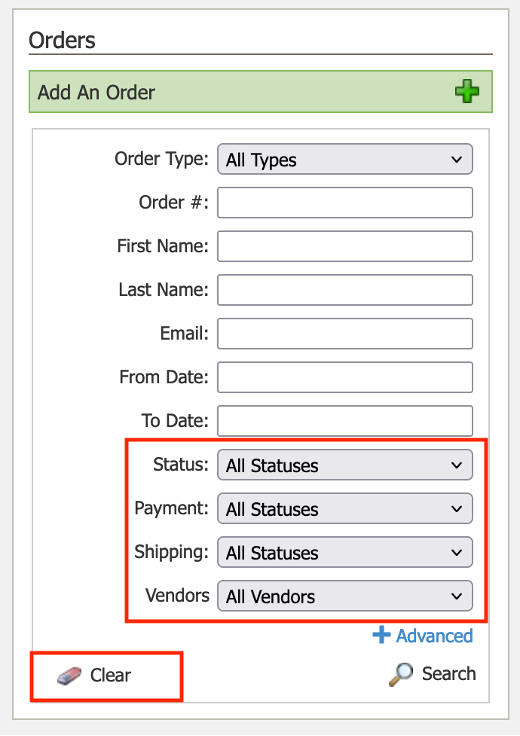

Go to Store > Order > Use CLEAR button on the search console > input the order number you find on WineDirect Payment's reports. After that, check each order's order status and payment status.