This documentation provides guidelines for setting up and managing the Santa Barbara County Wine Improvement District (SBCWP) - Wine Preserve Assessment in WineDirect for Santa Barbara County wineries that want to charge the 1% fee on ALL their California sales.

Best Practices for Implementing this Assessment

This option applies to the Santa Barbara County Wine Region - Wine Preserve Assessment and collects sales tax on the assessment. Follow the steps below to enable the assessment for your Classic Admin Panel:

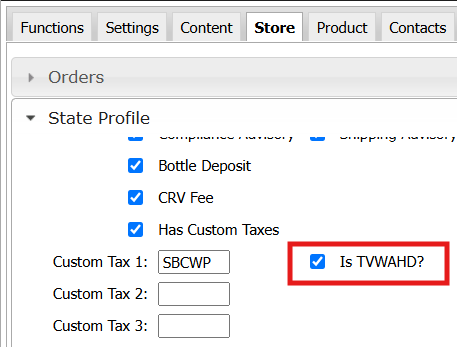

- Enable the TVWAHD Checkbox

- Go to Website Settings > Store > State Profile

- Check the box labeled Is TVWAHD?

- Modify the Custom Tax Field

- Once the checkbox is selected, the system will auto-populate "TVWAHD" in the Custom Tax Field

- Replace "TVWAHD" with “SBCWP”, or whatever you would like to name the fee (14 character maximum).

.png)

- Click on Apply Changes - bottom right corner.

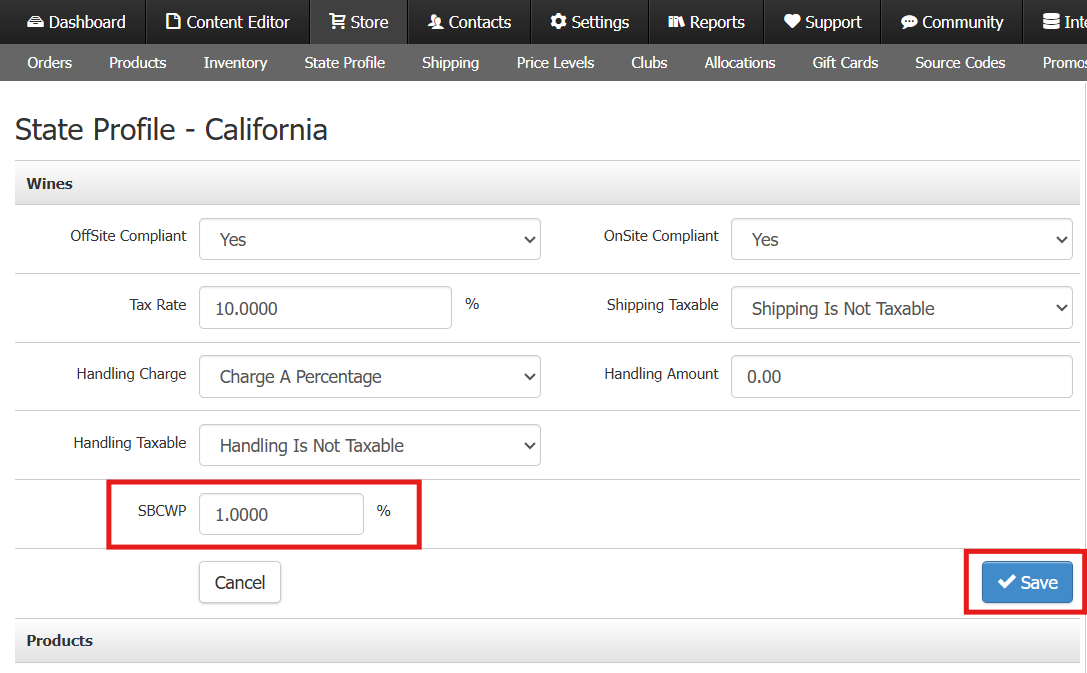

- Set the Tax Percentage

- Navigate to Store > State Profile > California

- Locate the Custom Tax Field under the Wines section and enter the applicable percentage (1%). The tax will apply to all product types EXCEPT Gift Cards and Credits.

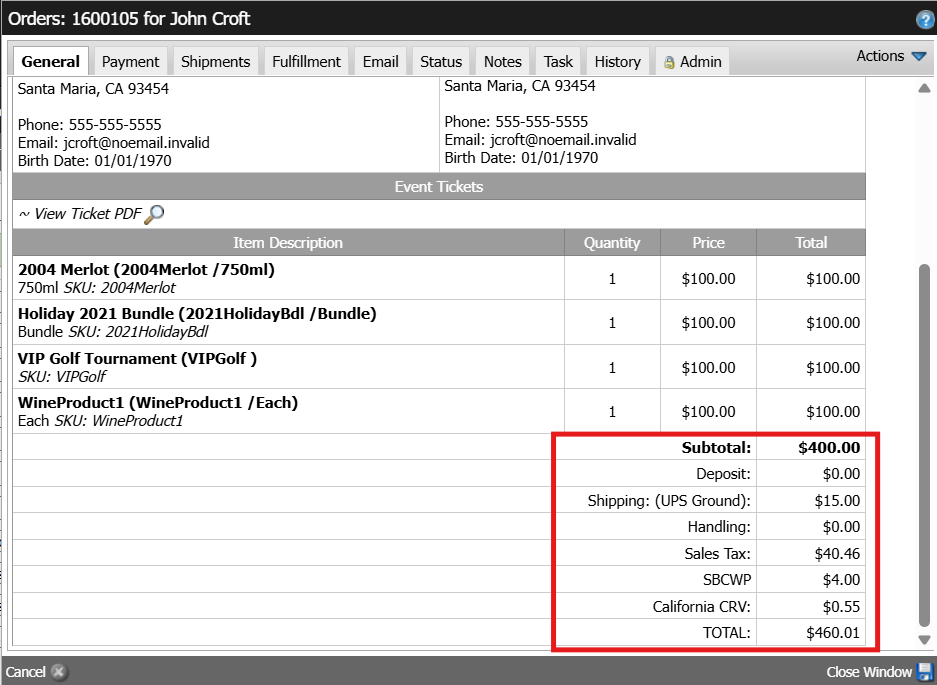

- Result:

- A separate line item for SBCWP (or whatever you named the fee) will be added to all orders shipped or picked up within California.

- Sales tax will be collected on both the subtotal and the SBCWP assessment.

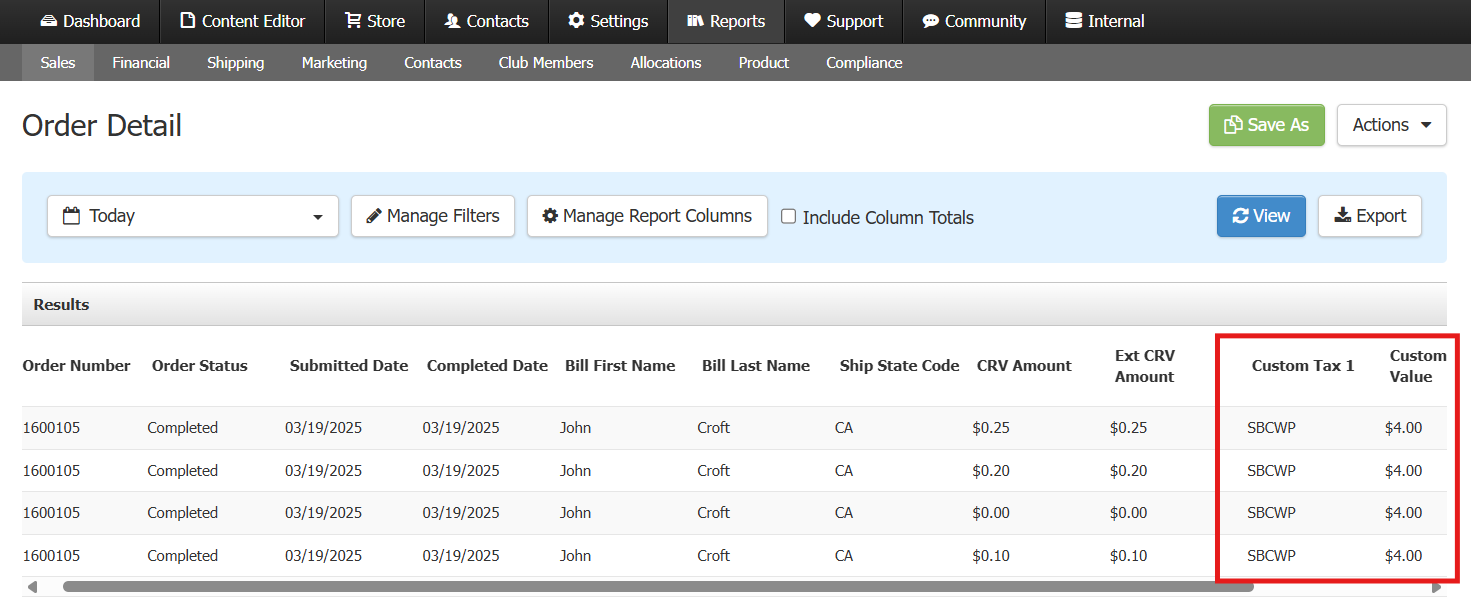

- The collected tax will be displayed in the Order Detail Report for reporting purposes.

Final Step: Notify Support to Enable Reporting

After completing the setup for the Santa Barbara County Wine Improvement District (SBCWP) - Wine Preserve Assessment, you’ll need to contact the WineDirect support team to ensure the fee information appears correctly in reports.

Why is this necessary?

The system requires a quick update from our development team to display the custom tax fields in the Order Detail Report. Without this step, the tax will be charged to customers but may not show up properly in reporting.

How to Notify Support

Send an email to support@winedirect.com or submit a support ticket through the Admin Panel Support bubble..

- Include the subject line: "Enable Custom Tax Reporting for SBCWP"

- In the message, mention that you’ve set up a custom tax and need it activated for reporting.

Once the support team completes this update, the SBCWP tax will be included in your Order Detail Report for tracking and compliance.

Reporting & Compliance

The Order Detail Report will include the custom tax amounts for proper reporting. Ensuring that:

- The collected SBCWP fees are reported to the necessary regulatory entity

- The correct percentage is applied based on current tax regulations