- 29 Mar 2023

- 2 Minutes to read

- Print

- DarkLight

- PDF

State Profile (Australia)

- Updated on 29 Mar 2023

- 2 Minutes to read

- Print

- DarkLight

- PDF

The State Profile section of the admin panel (Store > State Profile) allows you to set up your basic compliance and tax settings for each State. You will be able to assign tax rates to wine and non-wines products and add state handling fees or taxable shipping charges. The Price can include these taxes to adhere to Australian taxation requirements. You also can add special shipping or compliance messaging on per State basis.

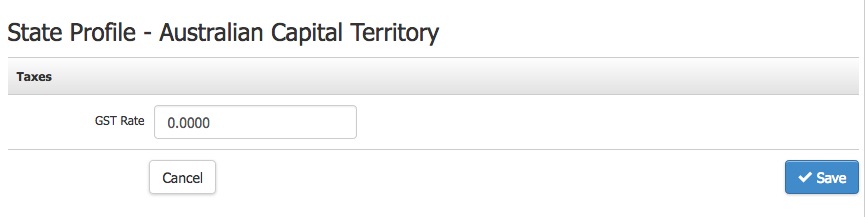

Taxes

The Wines section is where you enter the GST Rate and determine whether or not to Include Tax In Prices

1. Click on the State you want to configure

2. Click on Edit.

3. In GST Rate, enter the tax rate you want to charge.

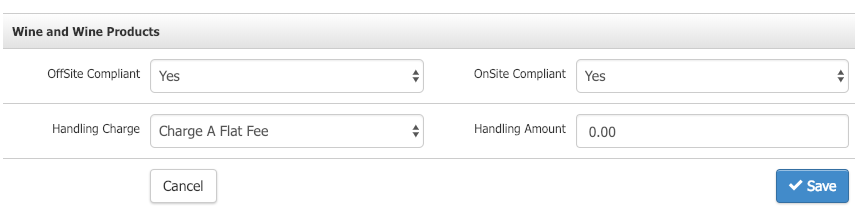

Wine and Wine Products

This section affects Wine and Wine Products.

1. Click on Edit.

2. Once you have filled out the Wines and Wine Products section form, please click Save.

TABLE OF DEFINITIONS

| OffSite Compliant | Select Yes or No if compliant for offsite orders (Orders placed on the website). |

|---|---|

| OnSite Compliant | Select Yes or No if compliant for picking up onsite orders (Orders placed through WineDirect POS). |

| Handling Charge | Select the method to use to calculate Handling (Flat Fee or as a Percentage) |

| Handling Amount | Enter the amount to charge for Handling (Flat Fee or as a Percentage) |

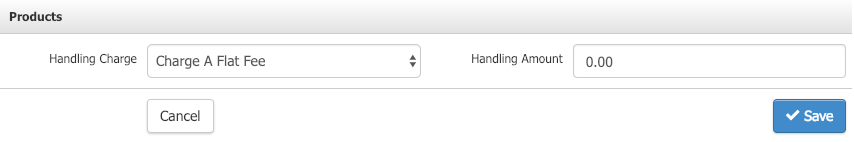

Products

This section affects Products (Products, Event Tickets, and Bundles)

1. In Handling Charge and Handling Amount, select the method to use to calculate Handling (Flat Fee or as a Percentage)

2. Remember to click Save.

| Handling Charge | Select the method to use to calculate Handling (Flat Fee or as a Percentage) |

|---|---|

| Handling Amount | Enter the amount to charge for Handling (Flat Fee or as a Percentage) |

Compliance

Compliance applies to your wines, wine products, and product bundles containing wine. Products, event tickets, gift cards, and other non-wine products are not checked for compliance. The WineDirect platform has a basic Yes or No compliance setting per State. This means that States marked as Yes will allow the wine to be sold to customers shipping it to these States.

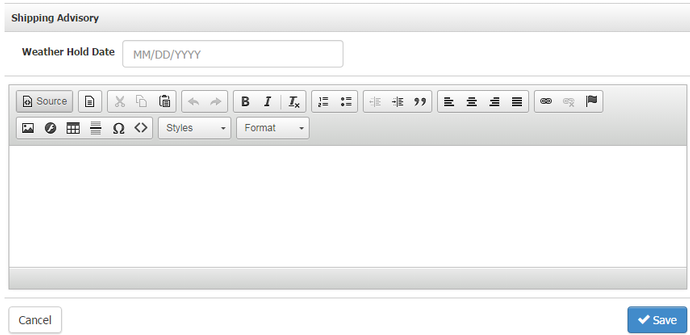

Shipping Advisory

The shipping advisory message will appear in the cart and checkout area. It can also be used to inform customers that wines will be held during hot/humid weather as it could spoil the wine and be shipped at a later date when the weather is more forgiving.

1. To have a weather hold date appear in the cart and check out, enter the date in the Weather Hold Date in the format of MM/DD/YYYY.

2. To enter a message, click the textbox, type in your message, and click Save.

Compliance Advisory

The compliance advisory message will appear on the product list and drill-down pages. This section informs your customers of any compliance issues regarding the selected State.

To enter a message, click the textbox, type in your message, and click Apply Changes.

State Profile FAQs

Are bottle deposits charged on Wine Products?

No, Wine Products will not be charged the bottle deposit that you have set up within your state profile.

Can I set a different compliance status for a specific product independent of my state profile?

You can do so by enabling Override State Profile with a Product's Manage Properties page. The specific states can be set from the Manage Compliance tab that will appear after Override State Profile is enabled.